雅思阅读

2017-07-11 11:20

来源:新东方网整理

作者:

新东方网雅思频道全新推出“每日雅思阅读精选”栏目,我们将为大家精心挑选国外网站上的优秀文章供考生们进行阅读练习,帮助大家提高雅思阅读水平,每天读几篇文章,每天有一点提高,相信不久之后,雅思阅读考试将不再是困扰考生们的难题。

推荐阅读方法:首先快速阅读全文,掌握文章大意,提高阅读速度;再进行精读训练,学习其中的词汇和语言的用法。

Inflation

Beyond goods and people

THE datasphere is bursting with inflation indexes (inflation inflation?). The Bureau of Labour Statistics provides consumer and producer prices while the Bureau of Economic Analysis gives us all manner of deflators. There are headline and core series (the latter stripping out especially volatile prices). One can look at price indexes for personal consumption expenditures (PCE), core PCE, "market-based" PCE, and core market-based PCE. There are chained indexes. The Cleveland Fed computes up median and "16% trimmed-mean" CPI.

These different indexes provide a check on each other, and are often good at highlighting particular sorts of trends in the data. And new research by economists at the New York Fed suggests another way of chopping up inflation figures that looks especially informative. As it turns out, goods prices and services prices tend to behave very differently, with important implications for macroeconomic policy.

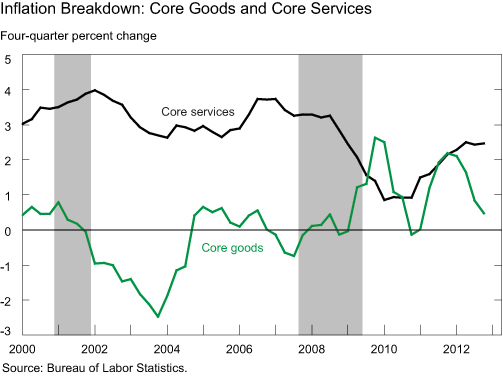

A post at the New York Fed's Liberty Street blog discusses the issue. You can see the divergence in core goods inflation and core services inflation in the chart below:

A few things stand out. One is how remarkably different the series are; goods and services prices occasionally move in opposite directions. Another is how very low goods inflation has been for more than a decade, only rarely straying anywhere close to 2%. And third, one's eyes are drawn to the contrasting and unusual moves from 2008 on. Those contrasting moves are important, the researchers say, because goods and services prices seem to react to different economic impulses:

"We find a strong relationship (both economically and statistically speaking) between core services inflation and long-term inflation expectations. There is also an important nonlinear relationship between core services inflation and the unemployment gap, indicating that the impact of changes in labor market slack on core services inflation depends on the level of slack itself.For the core goods inflation model, the results suggest a very different set of factors influencing the behavior of the series. We find persistence in the series, that is, core goods inflation depends on its own past value. Relative import price inflation—growth in (non-petroleum) import prices less core goods inflation—also matters, suggesting goods prices act as the linkage between supply shocks and core inflation. There is also evidence of a relationship between core goods inflation and expected inflation, but that the relevant inflation expectations are associated with a short-term (one-year) horizon. Last, we find no meaningful effect of the unemployment gap on core goods inflation, consistent with commentators who contend that it is global (and not domestic) economic slack that impacts core goods inflation.More simply, services inflation is about expectations and unemployment, while goods inflation is about global capacity utilisation. That makes sense; to a first approximation services are people. Goods are also people, a little bit. But they are more energy, materials, and supply chains. Goods prices rise faster when one of those three factors bumps up against constraints. Service prices rise faster when there aren't enough people to go around."

It isn't surprising, then, that services inflation tumbled when the crisis struck and millions of Americans became unemployed. What is interesting is that the resulting impact on inflation was masked a bit by movements in goods prices. They were rising; perhaps in part due to the lagged effect of commodity-price increases but maybe more because China's government was stoking its economy's engine to red hot levels. Disaggregating the CPI into these components helps illustrate how the Fed might have underestimated America's economic duress.

Interestingly, services inflation has trended upward over the past two years and was 2.3% in the year to April. Some might take that as evidence that the labour market is closer to full employment now than other gauges (including overall inflation) suggest. Alternatively, it could be long-run expectations reasserting themselves. But the new more-or-less stabilised rate of services inflation represents a marked downshift from the pre-crisis levels (which had been surprisingly constant at a bit above 3% going all the way back to the early 1990s). That means that services prices are moving farther away from the pre-crisis trend, rather than catching back up.

I like this way of digging into CPI data. But I also think it mostly reinforces the point that what monetary policy is really interested in is the labour-market output gap and its relation to wage growth. The prices for "stuff" don't matter, and we don't care if factories or stores close so long as everyone who wants to work can. The goods-services distinction is useful in that it shows us once again that on that basis the Fed has done far too little.

若想获取更多详尽出国留学攻略以及雅思培训资讯,可以打开我们【上海新东方雅思网】,涵盖雅思培训,雅思写作、口语、听力、阅读以及留学名校介绍等。上海新东方雅思网在这里预祝各位考生学习顺利,都能考取自己满意的学校。

扫码添加大队长Sam,领取最新沪上热门国际学校招生信息

A BETTER YOU,A BIGGER WORLD!

版权及免责声明

①凡本网注明"稿件来源:新东方"的所有文字、图片和音视频稿件,版权均属新东方教育科技集团(含本网和新东方网) 所有,任何媒体、网站或个人未经本网协议授权不得转载、链接、转贴或以其他任何方式复制、发表。已经本网协议授权的媒体、网站,在下载使用时必须注明"稿件来源:新东方",违者本网将依法追究法律责任。

② 本网未注明"稿件来源:新东方"的文/图等稿件均为转载稿,本网转载仅基于传递更多信息之目的,并不意味着赞同转载稿的观点或证实其内容的真实性。如其他媒体、网站或个人从本网下载使用,必须保留本网注明的"稿件来源",并自负版权等法律责任。如擅自篡改为"稿件来源:新东方",本网将依法追究法律责任。

③ 如本网转载稿涉及版权等问题,请作者见稿后在两周内速来电与新东方网联系,电话:010-60908555。

雅思阅读